Faça sua Pesquisa

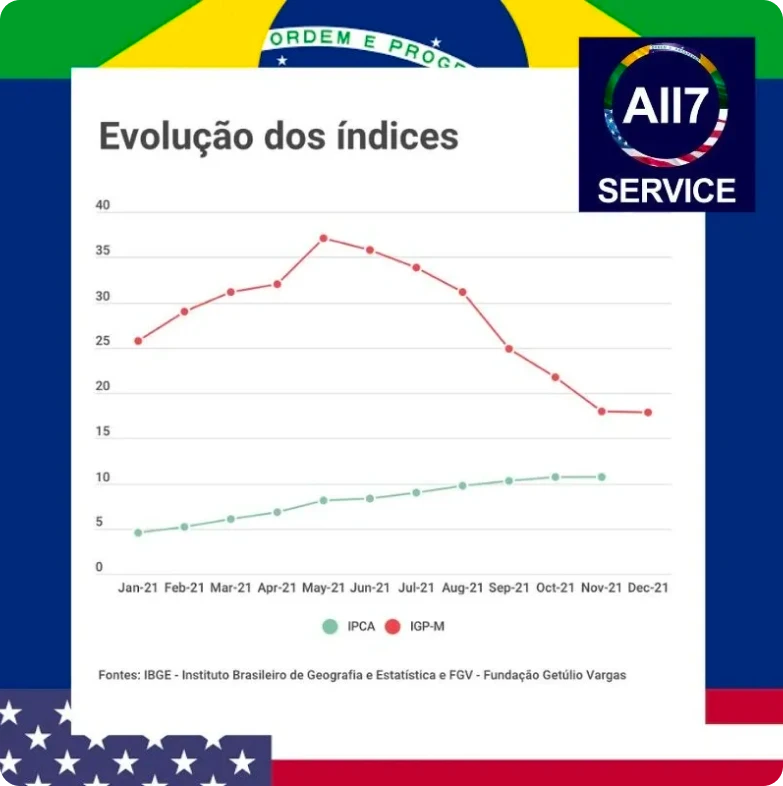

The IGP-M tends to remain above 15% in 2022 while the IPCA is expected to decrease and stay close to 5% during the same period, according to the goals of the Bolsonaro government.

However, 2022 is an election year, which creates political instability with economic consequences.

There are still remnants of health instability with the emergence of new variants, and the pace of vaccination is inconsistent among nations.

Adding to these instabilities is the exchange rate, which, with the disruption of the production cadence due to intermittent lockdowns worldwide, has led to increased costs in maritime transport and energy base.

In this scenario, I can say without a doubt that the Brazilian government is very optimistic. However, we must not lose sight of the increases in the SELIC rate by more than one percentage point, which is slowing down the economy and, in turn, curbing inflation.

The real estate market has already understood that applying pre-pandemic contractual rules to contract anniversaries is unsustainable and unfeasible.

Additionally, speaking of the real estate market, Exame magazine published the following statement on January 8, 2022:

"Adding to the rise of the IGP-M is the current moment of the SELIC rate, which serves as a benchmark between the purchase and rental markets. I remind you that, running the risk of stating the obvious, the SELIC rate comprises a basic cost for credit operations, including real estate financing. Thus, its increase impacts the cost of granting real estate credit, which pressures the interest rates of these operations, which in turn slows down the demand for purchasing properties." Source: https://exame.com/blog/genoma-imobiliario/o-que-esperar-do-mercado-imobiliario-residencial-em-2022/ accessed on 01/09/2022.

The construction sector is feeling the increase in two basic items in the segment, iron and cement, and on the other hand, feeling the decline in financing due to the increase in the SELIC rate. If profit margins were already tight, they will become even more so.

As a result, the trend is an increase in the demand for renting instead of financing.

Since April 2021, the Brazilian Supreme Court has been holding the judicial process that requests the change in the rental adjustment index from IGP-M to IPCA. Numerous lawsuits in the country argue on the same matter, without the STF giving a final word on the topic, which leads to contradictory decisions in the national judiciary, increasingly creating legal uncertainty.

Lawyer Daniel Cerveira points out that a large part of shopping centers remain inflexible regarding rental values. Many shopkeepers suffered from the IGP-M adjustment in 2021. Additionally, Daniel notes a trend of shopkeepers taking legal action against shopping centers to reduce the cost of occupation in these large shopping centers.

In summary, the key word is negotiation, negotiation, and negotiation. A good agreement between the parties is preferable to the strain of judicial litigation.

Diego Ramos Corrêa is an Accountant with an MBA in Auditing, Controllership, and Accounting Expertise, certified by the Brazilian Institute of Internal Auditors in Corporate Fraud and specializing in Federal Taxation from Illinois University. He is a member of the CRC MT Accounting Auditing Study Commission and an invited member of the CRC MT Electoral Commission for the 2021 election and founder of All7 Service.